I have been living with my family in Thailand for over 25 years and we have always rented an apartment or a house. Simply put, Thailand has extremely stringent and somewhat elusive regulations regarding renting vs buying properties.

However, it is also pretty straightforward. There are 3 things to know:

- Foreigners cannot own land in Thailand.

- Expats or foreigners are allowed to own condos or buildings/structures

- Thais must own 51% of a Condominium Project. Foreigners may own up to 49% of the property.

Source: Freshbangkok.com

Our experience

Currently we rent an apartment in downtown Bangkok – Asok to be exact. Our condo is quite old and lacks features that the new properties flaunt. However, it is also extremely spacious at a whopping 600 sqm. 4 bedroom, 4 baths, two massive living rooms, a kitchen and a store room. All for 80,000 Baht a month (2,600 USD).

The sale price for this apartment is around 25 Million Baht ($ 832,459). In any other country, we would have bought this apartment long ago but because of insane red tapes and a rigorous process, we have continued to rent for the last 15 years.

We’ve moved around Thailand before that.

Recently, my dad bought an apartment as an investment for our future. A small apartment at one of the new condos in Bangkok. A 41sqm one bedroom for 4.5 Million Baht.

My dad explains that it was one of the hardest things he has ever done. The process was brutal.

“The money cannot come from Thailand and even though I get paid in dollars from the U.S in consulting fees, I cannot use that to buy property also. It has to be a specific transfer marked for the purchase of property”.

Basically he had to go through a lot of backdoor but legal channels. Suffice it to say, it was a hassle. All for a tiny little apartment.

Unlike in UK or Dubai or almost anywhere else, you can apply for mortgages through banks, in Thailand getting a mortgage is difficult.

Interview with an expert

I spoke with Marciano Birjmohun, the director of business development at Fazwaz for some insights on the real estate market in Thailand.

How has the COVID-19 pandemic affected the real estate market in Thailand?

Covid can be viewed as “the straw that broke the camel’s back”

Covid can be viewed as “the straw that broke the camel’s back”, especially in the Bangkok market. For years, the property market has overflowed with unnecessary supply, paired with marketing strategies to attract speculators into a non-existent buy-to-let environment. The coronavirus pandemic comes at a moment where the Thai real estate market has seen an over-supply coupled with reduced demand since 2019 due to appreciation of the baht and overall economic sentiment. It’s not viable for developers to maintain the same price points with no uptake, and the post-COVID situation will have repercussions for the sales cycle for years to come.

For Expats, can you suggest when it is a good idea to buy a property over renting?

It all comes down to liquidity and ability. For both locals and expats the mortgage rates in Thailand are currently historically low – providing opportunities for savvy buyers to make their move. I would advise buyers to negotiate with sellers comprehensively. There are “real deals” in the market and some properties are let go for 20-30% under market value. If we look at the developer inventory, you can definitely reach double-digit discounts and additional incentives such as free transfer, free furniture, and free CAM fees.

What are some tools or websites we can use to calculate things like mortgages?

Every bank has a mortgage calculator on its website with up-to-date rates and promotions. Bigger agencies (FazWaz for example) have embedded mortgage planning and calculations on their websites for the convenience of the consumer.

Next to that, an online valuation model will be launched in Thailand, a game-changer for local and international real estate investors

There are mortgage calculators in the UK that help you plan real estate purchases, so it will be interesting to see a similar tool being used in Thailand.

Some interesting real estate stats in Thailand

- By the end of 2020, prices are expected to drop by 2.4% before climbing 5.6% by the end of 2021.

- Chiang Mai will see the highest jump of 12.8% next year after facing a downturn of 2.8% this year.

- Bangkok is likely to face the biggest swing as prices are projected to fall by 4.9% by the end of this year and increase by 7.4% by the end of 2021.

- Foreign buyers accounted for 31% of transactions for nationwide new residential sales.

- Nationwide, 35% of agents reported that foreign buyers would make more purchases in the year to come compared to 2019.

Source: Bangkok Post

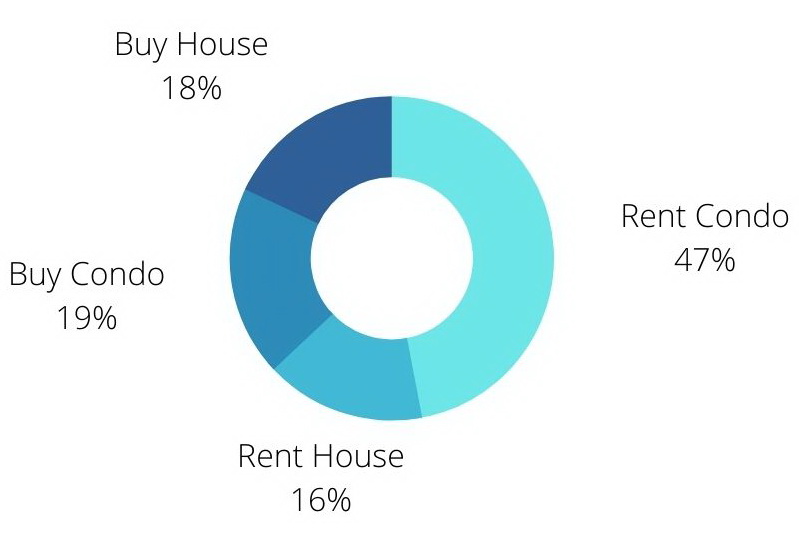

I also asked some of my expat friends whether they rent or buy in Thailand. A 100 of them responded.

I’d like to know in the comments what you think about the real estate (especially the condos) market in Thailand.

Personally, I agree with Marciano. There is an overabundance of condo buildings, most at ridiculous prices and there is hardly anyone staying in them.

Yes they seem to keepbuilding and building. There seems also to be a move away from the new mini sized condos also as covid taught us we need a little more space to live comfortably.

Great insight Mike. You are correct. We have way too many condos now and they are eating into other things like markets, parks, etc.